Getting started

Getting started with Open Banking PSD2 integration

To begin using Paysera's Open Banking API for PSD2 integration, follow these steps:

- Read the documentation: Familiarize yourself with the API structure and key concepts.

- Contact Paysera: Reach out to gain access to the service and ensure that necessary permissions are granted.

- Prepare your integration: Use the documentation to configure and test your system.

Integration flow overview

To successfully integrate as a third-party provider (TPP) with Paysera (ASPSP), specific steps must be followed and completed.

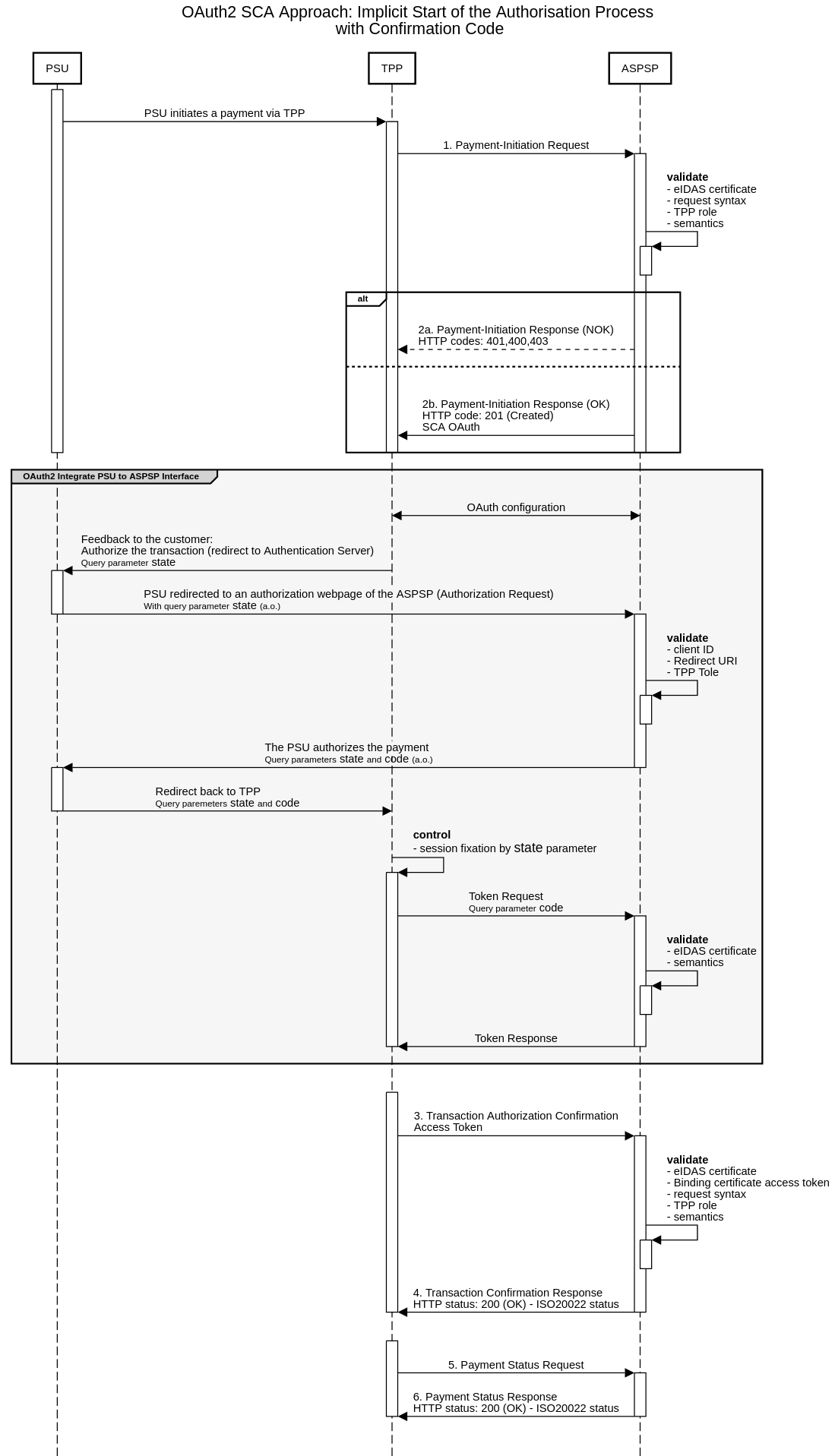

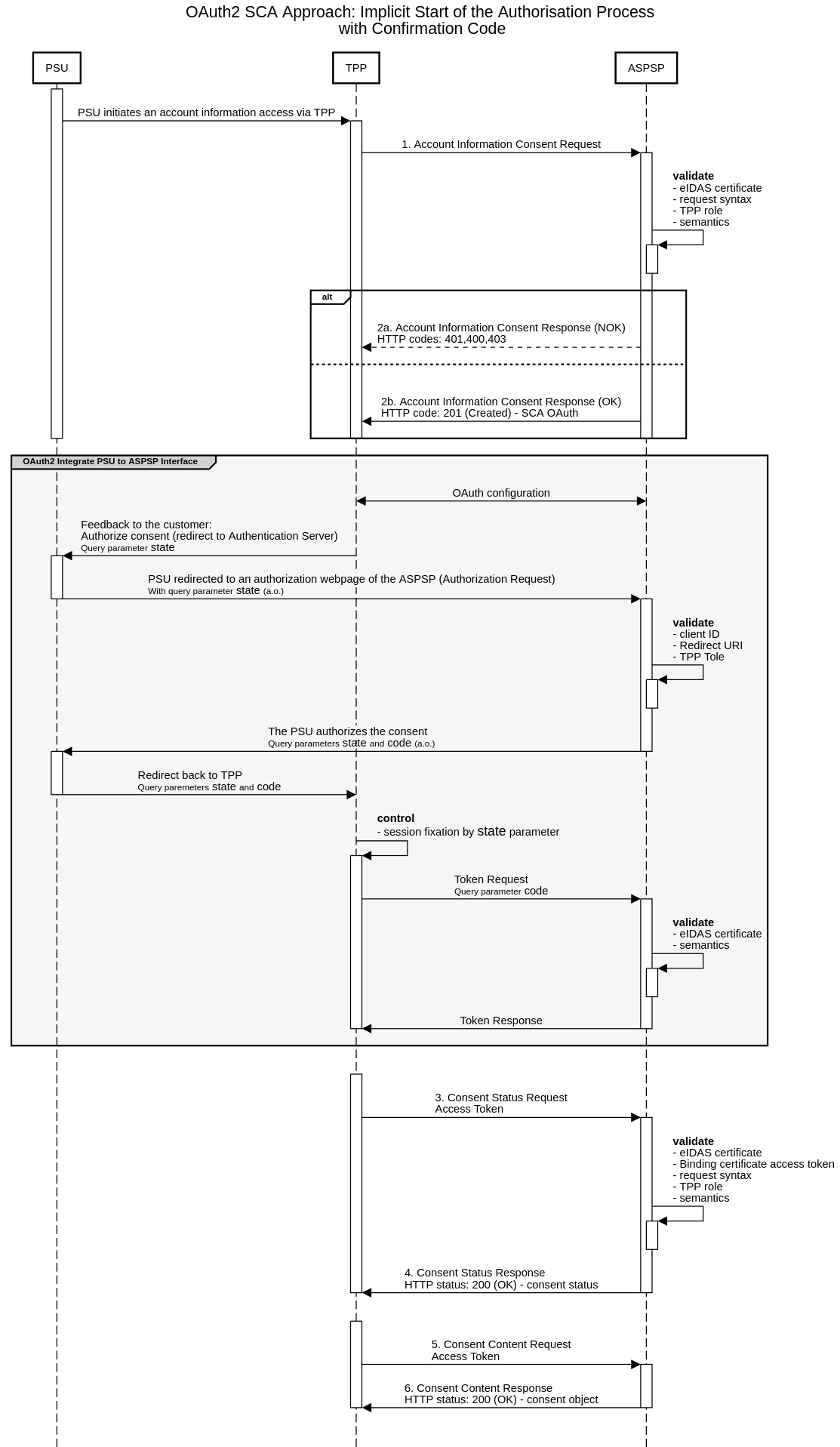

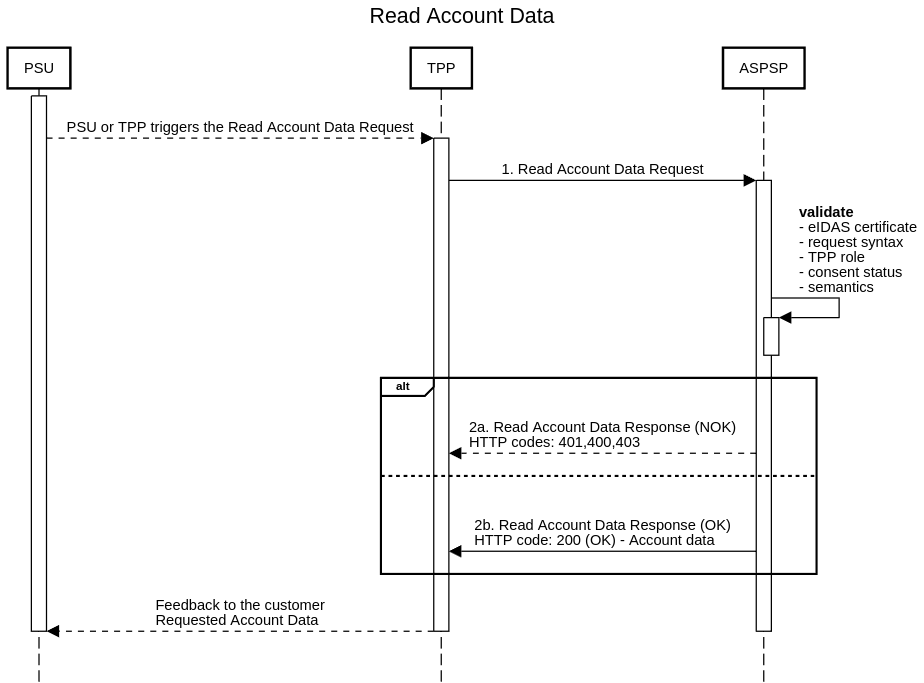

The interaction between the customer (PSU), TPP, and ASPSP is detailed in the integration sequence diagrams below.

For the details on specific requests data and theirs specifications, see Georgia v0.8 specification or Berlin group standard v1.3 specification.Payment initiation flow

Use this flow if there is no information about the exact payer account during payment initiation:

Note: Paysera uses the OAuth Strong Customer Authentication (SCA) flow to confirm payments. To execute payment orders, the TPP must have PSP_PI (Payment Initiation) role enabled in its eIDAS certificate's qcStatement section.

Account information: acquiring user consent flow

To collect PSU account information, you must first obtain user consent. Follow the integration scheme below:

Retrieving account information flow

To collect PSU account information, you must first obtain user consent. Once user consent is obtained, use the integration scheme below:

Note: Paysera uses the OAuth strong customer authentication (SCA) flow to confirm payments. To retrieve PSU acccount information, the TPP must have the PSP_AI (Account Information) role enabled in its eIDAS certificate's qcStatement section.

Authentication process

Authentication is performed by using a QWAC (Qualified Website Authentication Certificate):

- Submit the QWAC certificate: Provide your QWAC certificate to Paysera administrators for approval. Find Paysera contacts at the bottom of the page.

- Permission setup: Paysera will allow to use the provided QWAC and grant access to specific information based on your certificate.

OAuth flow

OAuth is used to authenticate and authorize API requests. Paysera supports the OAuth 2.0 protocol for secure communication.

For a complete overview, detailed guidance, and implementation details of OAuth 2.0, refer to OAuth 2.0 documentation.

OAuth configuration:

Access Paysera’s OAuth configuration details here: https://open-banking-api.paysera.com/.well-known/oauth-authorization-server

Steps to authenticate using OAuth:

- Obtain an authorization code

- Direct the PSU (user) to the authorization endpoint.

- They will log in and grant permissions.

- Expected result: An authorization code is sent to your redirect URL.

- Exchange the code for a token

- Send the authorization code to the token endpoint to receive an access token.

- Expected result: You receive an access token.

- Use the access token

- Include the token in the Authorization header for subsequent API requests.

Appendix A: National Competent Authority (NCA) Registers *

* The list might be outdated or incomplete.